PERSIMMON – Stock Analysis on and Trading Methodology.

Ticker: LSE: PSN

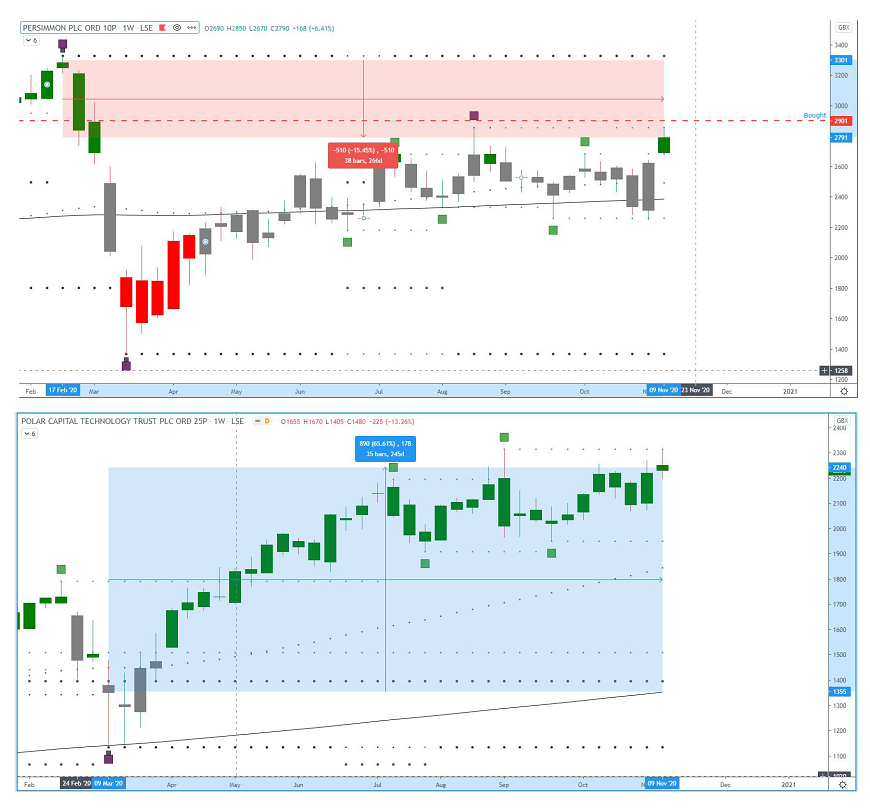

Persimmon – Bought in – 17/02/2020 at 2901

2733 on 9th Nov 2020

This means that we have waited around 9 months for it to get somewhere remotely close to our buy-in price, though we are still short.

Now, of course, this stock may not only get us back to where we bought in, but it may also pass this area and finally return us a good profit.

If this happens, this means that we were right, our trading methodology has paid off on this stock – VINDICATION!!

Ok, now here’s the rub…

Let’s say we put £5000 down on this stock on 17th Feb 2020. On 17th March, it has shot down around -53%, all things being equal, this would have turned out £5000 into £2350.

But, with all the nice climbing, it has clawed its way back to only -15.45%, so now our £5000 is worth £4227.50. Fair do’s, that is a lot better than the serious hit to our funds we were looking at earlier.

As you can see, we are still running at a loss on our original investment, and this is not the way we should be trading.

Trading should never be about BEING PROVEN RIGHT within a trade, whether we think so or not, this is emotional trading. Yes, even if we have done all our fundamental research and are pretty darned sure that the stock will climb back, this is still a risky way of trading.

Why is it risky? Well, at the very least, we have just had funds tied up for 9 months and that 9 months has done our fund’s little favours other than to so far, lessen the loss. Don’t get me wrong, a loss of £772 is better than a loss of around £2700, but again, there must be a better way.

On a positive note – (and let’s hope that other trend traders haven’t read this far as this next comment, I’d be cast aside by them )

But, I have to say that Persimmon has done a great job of clawing their way back from where they were, especially during this current climate. Yes, even I am impressed at the way they have almost got back on track.

The problem with my comment above is that “I am impressed at Persimmons achievement”, and this means that there are now emotions involved. A big no-no for trading, no emotions.

Let’s try the above from a trend traders perspective… (the cold, heartless souls that they are!)

1, We step into the Persimmon Trade and buy £5000 worth on 17th Feb

2, On 02 March, our money starts a serious slide down, so our Stop Loss cuts us out and we now have £4500 left.. (no, this doesn’t mean that stop losses should be set to 10%, I am only using this for simple purposes)

Note: Don’t get me wrong here, a £500 dent in our funds will feel like a gut punch, no denying that. Also, we are having to admit that our trade was going sour on us. Truth be told, still, to this day, I don’t like admitting that, I don’t think anybody does, but I have to…… AND HERE IS WHY!

3, I now take my £4500 and decide to put it on PCT (Polar Capital Technologies). I do this on 9th March 2020.

4, From 9th March until today, PCT has gone up 65.61%, which means that my £4500 would have gone up to around £7452… I think this would totally lessen the gut punch from the original loss on Persimmon

If that doesn’t bring a little smile to your face, then maybe you’re more machine than you realise

So, looking at the above example, the 2 options given to us here were:

1, Leave our funds within Persimmon and still be running at a £772 loss, which is a lot better than the original loss.

2, Admit that the trade had turned on us, so we regroup, we rescue our remaining funds and then put them in another very good trending stock, and this time, the stock returns us a decent gain. This would also mean that our original £5000, including the £500 loss from the original hit, has now returned us £2452 gain.

There are 2 very difficult things for most traders to do and in this example, we have covered one of them, and that is…

KNOWING WHEN TO WALK AWAY FROM A LOSING TRADE!

Yes, at times it may feel like we have got it wrong, we have let ourselves down and have lost some money in the process, but this is only a temporary thought and will soon pass. Learn how to control this and not to let emotions control it and we stand to make a lot more in the end.

But there is a third option that you haven’t covered!

Ok yes, there is a third option, so let’s touch on that also.

You could also double down on this stock, which is another way of saying, buying more as it is plummeting down, so we would be, Cost Averaging. This means that our original buy-in price has now been averaged down.

Yes, this is a way of lowering your original buy-in price, though the issue with this is that we have no idea of when it is going to come back to its pricing. We also have no idea of how low it is going to fall.

This scenario would give a trend trader, nightmares as it is tantamount to standing in the sea with your hands out, trying to stop a wave from going past you and crashing onto the shore. Ok, a bit overkill with that example, but the concept is the same thing. You are buying more of a sinking trend and you have no idea of how far it will plummet and for how long. <– These two unknowns can cause all sorts of issues with our hard-earned money as we have now added even more variables into the mix.

I was told by a trend trader, not to let my ego get in the way of my trading. Of course, when one has that said to them, the first thing you are going to think is “EGO! who the heck do you think you are, telling me this?”

Once one understands the mindset and realises that this isn’t a personal dig and actually comes from a caring side and other trend traders are only trying to be helpful, then the potential to earn and make more, suddenly appears on the table.

In the above write up/example, Persimmon was used for a reason. You see, this is a stock that I traded and did this with. This is my personal experience.

I have traded for a little while and used a few different techniques along the way, plus mixing and matching them to see what works best.

I have known about momentum trading for a while and was offered a chance to tie up the loose ends within my strategy. The team that helped me do this, don’t mess about. I will be the first to admit that they can be quite strict with making sure they drill home their methodology.

There are many ways to trade and one has to find which one is right for them.

If one wants to learn more about this way of trading or to see any free tutorials on how you can adopt this style of trading, then please feel free to leave a message or get in touch and I will happily send over any information you require

I hope this simple post can help some understand that sometimes, there are better options than just hanging onto a stock, just so as to be proven right and IT CAN come back into profit, as that sort of thought process can often end up meaning that we walk away with less profit in the end…