Learn how to take back control of your finances and create wealth for you and your family with financial education.

The incentive for writing this article came about after having conversations with other investors and family and friends on the topic of money.

After numerous conversations on the same subject over the years, you begin to see a pattern emerge, and a pattern you will find impossible to ignore. What became apparent was the complete lack of general knowledge when it came to making, managing and growing money.

This lack of knowledge comes down to financial illiteracy but through no fault of their own. I have to admit that when I was growing up, particularly in my teens, I had no knowledge of money as I wasn’t taught anything on the subject.

Any money left over from my weekly allowance was saved and then spent without hesitation after looking through catalogues for the latest hot toys and gadgets on the market.

Although I had it in me to save to buy these products, what I was not taught was how to budget to put my hard-earned savings to better use. As a result, I had nothing to show for my savings years later as the reality is I didn’t know how to!

Now before we proceed any further, let’s take a moment to look in hindsight to see what is possible over a period of time.

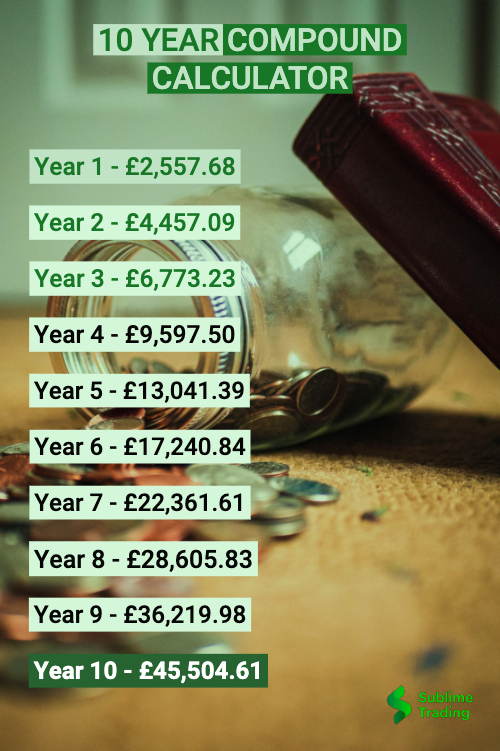

Suppose you find an investment to put your savings into that can return you 20% per year on your investment. This percentage may seem a lot or even unrealistic given what the banking system has offered us growing up but with the right education, it is not uncommon to make returns in this region and even higher.

Just having an initial investment of £1,000 and adding just £100 a month, over a 10 year period with a 20% annual growth, your initial £1,000 would turn into £45,000.

The total of monthly payments would have equated to £12,000 and adding this figure to the initial £1,000 investment that would have equated to a total of £13,000. This leaves you with profits of £32,000.

Now imagine having that initial £1k mentioned above as your starting amount at the age of 18. Imagine then being taught to manage and invest that whilst being encouraged to add an additional £100 each month for 10 years.

Imagine that feeling of having accomplished turning that £1k into £45k by the time you are 28. £45k is a decent sum of money, it’s a salary for some people.

The options you would have open to you at a young age would be endless. You could keep investing part of the money and use the rest for starting a business or getting a property. This would have put you miles ahead of the rest of the population.

But there is no time for regret, just action!

This article is directed at people of all ages because even when starting to invest in your 40s/50s you can still build up a healthy-sized pot for retirement and not be reliant on the measly amount offered by a state pension or workplace pension that would bring in much smaller returns and that is if pensions even exist when the time comes to start claiming yours!

You can make investing as passive as you like which is why we want everyone to understand that there are just a few hurdles, if any, in the way of achieving great financial success over the years with very little stress.

Our aim, as financial literacy is not a part of the school curriculum, is to educate and demonstrate how to think about money and provide you with the necessary tools to change your perspective, eliminating the negative connotations some people may have in regards to thinking money is the root of all evil.

We want to give you all the information we wish we had received many years ago, and remember, it’s never too late to get started. Finding this article may have proved timely as you are just in time to turn a negative into a positive outcome and regain full control of your financial education in an increasingly expensive world.

By reading on, not only will you achieve this but you will learn to do what many people have not even thought about, or if they have, they lack the understanding of how to implement this which I will be covering later, and this is to move away from the idea of working for money and instead have money work for you.

This transition doesn’t happen overnight but with the correct changes made to your finances, you will have money working for you round the clock, for years on end.

There is money circulating around you right now as you are reading this and all it takes is for you to acknowledge this and make the decision to have your share of what technically is rightfully yours having worked or are likely to work for most of your life.

We should assume that by you reading on, you have made a conscious decision to get educated so you can start claiming some of that money in circulation that is rightfully yours. Before we delve into how you do this, let’s demystify certain common beliefs that the general population has about money which will hold them back from creating wealth.

1. What Most Of Us Think About Money

Chances are you have had the age-old saying ‘money is the route to all evil’ drummed into you while growing up, which is more than likely to have created your current belief system about money.

If money is evil then you may believe it is best to only have the amount of money you need and nothing more. Saving money, and certainly investing it, will be frowned upon. Life would be better without it, right?

It is easier to sit back and focus on the news stories of unscrupulous rich people receiving convictions for conning innocent people out of millions to make themselves richer. Stories like these make it easier for people to stay comfortable in a position of earning very little, assuming that having less money makes them more virtuous than others.

Life may be simpler this way but it surely won’t be pleasant. To make things worse and to compound the effect, your social circle probably has the same mindset and thoughts causing you to remain in your current position. As the saying goes, you are the company you keep.

How you deal with money can vary with different individuals. States of happiness and sadness can be exaggerated with more money. For sadness, in particular, personal issues should definitely be resolved first simply for a state of wellbeing.

Always try and be kind to yourself. This is then likely to have a positive impact on your life’s successes and in turn how you view the money that may come from that.

Some people may have a sense of guilt of having large sums, potentially millions, in a bank account knowing that there are many around the world living in poverty. The feeling of “do I deserve this?” may hang over you and this can mentally block you from pursuing any goals you have to creating wealth for yourself.

But do keep one thing in mind, if you were to create vast amounts of wealth, which is more than possible for those that are determined to with the opportunities available to us all in the online world we live in, then think of the position that you will be in to help those around you.

With money, comes responsibility and you may surprise yourself and thrive with your new-found wealth being able to pay things forward.

2. Effects of Poor Financial Literacy

A very important fact to remember is that money doesn’t grow by itself. It needs some managing from you which even a basic understanding of how to do this will do wonders for your top-end.

For example, think of all the lottery winners that have gone broke in only a few years, millions just vanished. It is believed that 70% of lottery winners go broke. The average lottery winner buys 4.5 cars, spends on lavish holidays and huge chunks of the winnings are given to family and friends.

One winner in the UK gave £4 million to his football club, only to lose it and more when the club went into administration.

If we are taught some simple money-management principles from a young age, or any age for that matter, and repeatedly practise them then managing and growing money will come with ease and be part of our subconscious.

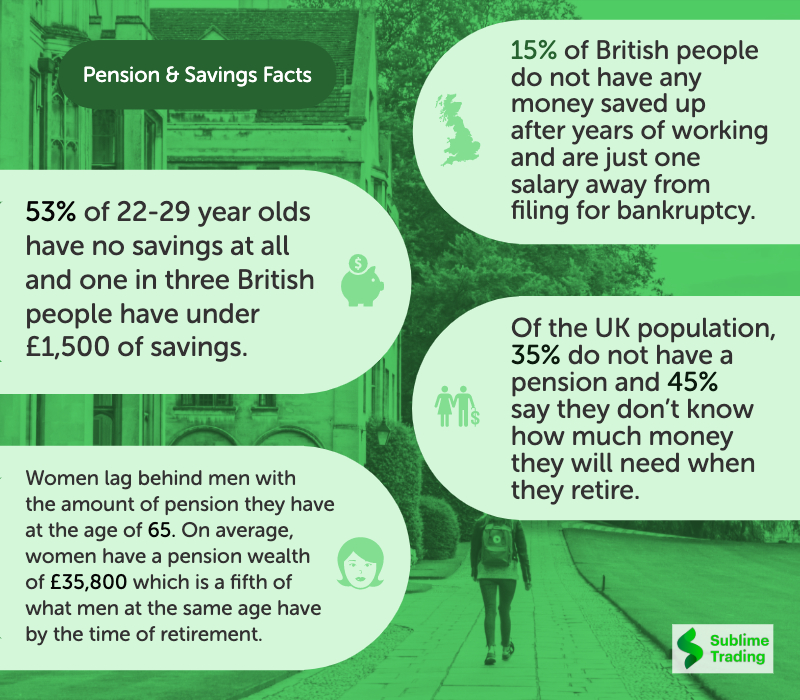

Poor financial literacy prevents the majority from thinking ahead about their finances.

Questions to think about:

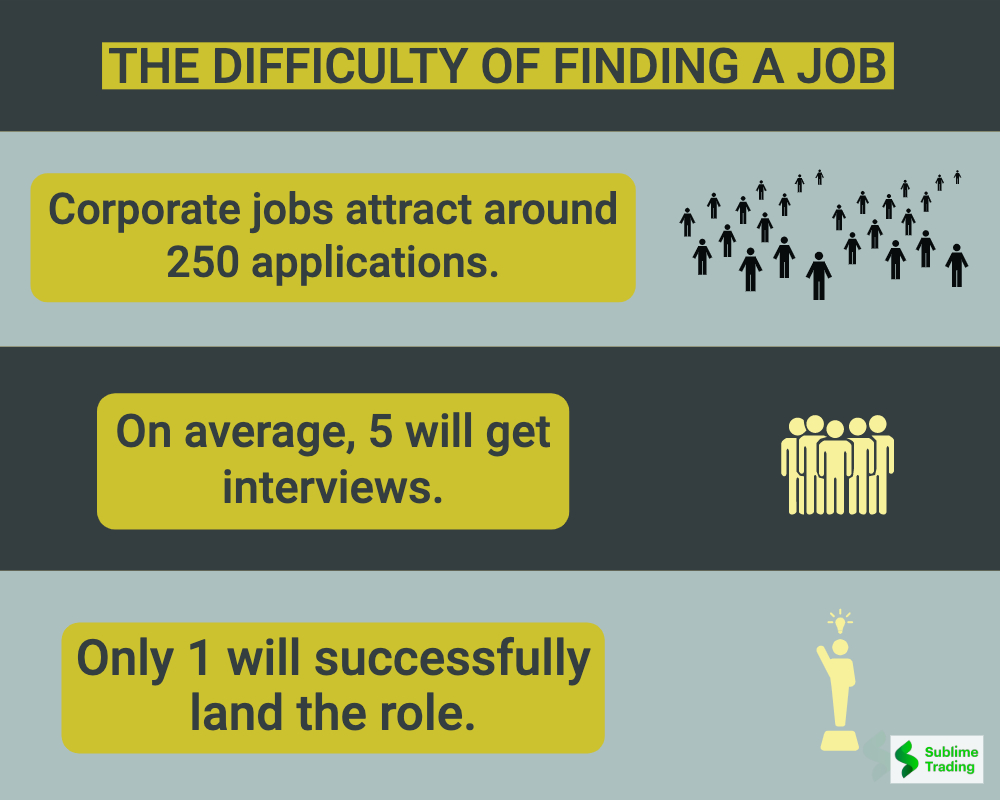

- How long can I survive financially if I were to lose my job right now?

- What will happen to those that are dependant on me if the money stops coming in?

- What can I do right now to create a passive income stream that will make money for years to come, even while I sleep and work?

With these kinds of odds stacked against you, it may prove very difficult getting a job in a short period of time. If a person has 3 months or less worth of salary in savings, they will be playing financial roulette as losing their job is a risk most people face.

Knowing this should not scare you but propel you into taking action and put control firmly in your hands. We will be covering how to take control and create long term wealth in the later sections.

Now that you are thinking more about how to control your finances, ideas may be coming to you in order to help you start saving rather than wasting your hard-earned money. Often, people don’t have an income problem, they just have a spending problem.

A third of British workers say they double their spending on unnecessary items on payday leaving them struggling with money until the next payday.

With most paydays falling on a Friday, it is the norm to visit a bar with workmates to unwind after a long hard week in the office. And not just on paydays, working in the City can see a big portion of your money spent socialising as this is almost expected of you.

Reducing activities such as these can go a long way when trying to save up and invest for the long term. These changes just require discipline to start off with and after forming a habit of saving, it can take on a life of its own.

I am not saying don’t have a social life, instead have a smart work, life balance that allows you to save a lot more than you spend. Sacrifices like this are essential for the greater good.

Change starts with you. Poor financial literacy is like DNA, it can and will be easily passed onto your children in the same way our parents are likely to have passed it onto us through no fault of their own.

However, unlike our parents, we live in the tech and information age. It is far easier for us to get educated than our parents and so staying ignorant is a choice when it doesn’t take much to be the complete opposite.

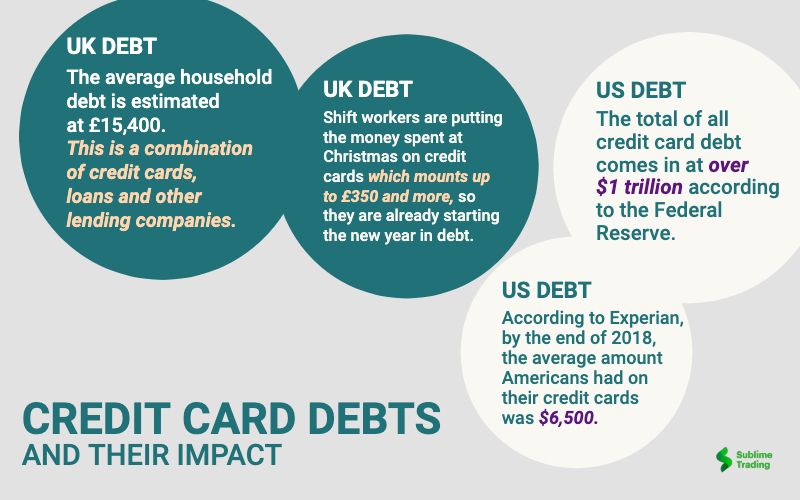

We need to break the cycle otherwise your children will have to learn the hard way how not to use a credit card when it is too late and they are struggling with debt payments.

The time to get clued up on managing our money is NOW especially as we have tools that can easily assist us in achieving this. There really are no excuses other than your choice to stay ignorant which will continue to have a negative impact on the people around you and those that come after you. Be that person that changed the game for the better for good.

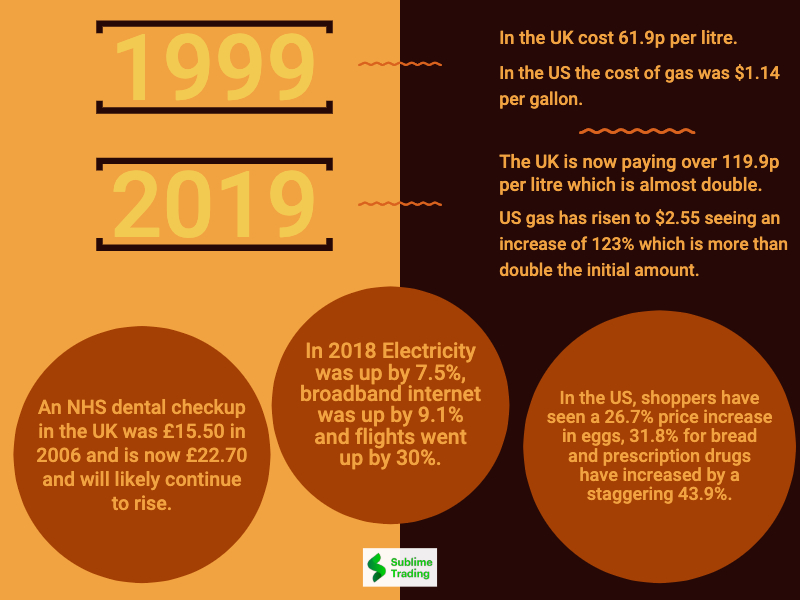

3. The World is Getting Expensive

When I began investing my own money, it was in order to create my own economy and generate wealth for myself and my family. Investing and managing your money has become a necessity and if people choose not to start now then people will continue to feel the impact of rising costs of everyday items whilst salaries will stay virtually the same.

Inflation

Inflation is simply the rate at which the prices for services and goods increase.

This information is important because it gives us an indication of what we can buy with our money. If inflation increases then your local currency will not be able to buy the number of services and goods it could prior to the inflation increase. If inflation decreases then we will be able to spend more on services and goods than we did prior to the inflation decrease.

For example, if the inflation rate for the price of petrol has increased by 5% from the previous year then we would need to spend 5% more of our money for the same amount of petrol than we did a year ago.

Over a 10 year period, from 2008 to 2018, if we were to look at the cost of spending £100 on goods and services in 2008, the cost of paying for the same goods and services would have cost £131.07 in 2018. This has been an average increase of 2.7% a year which is a 31% increase in the amount spent.

The question you need to ask yourself is if the costs of goods and services are going up then how will our current salary support us if our salary stays the same or climbs up much slower which is what, comparatively, it is actually doing?

If you are barely kept afloat with your finances under your current salary then suppose if the cost of living has increased by 31% over a 10 year period as mentioned above, then have you thought about how will you cope unless your salary also increases by 31% or more?

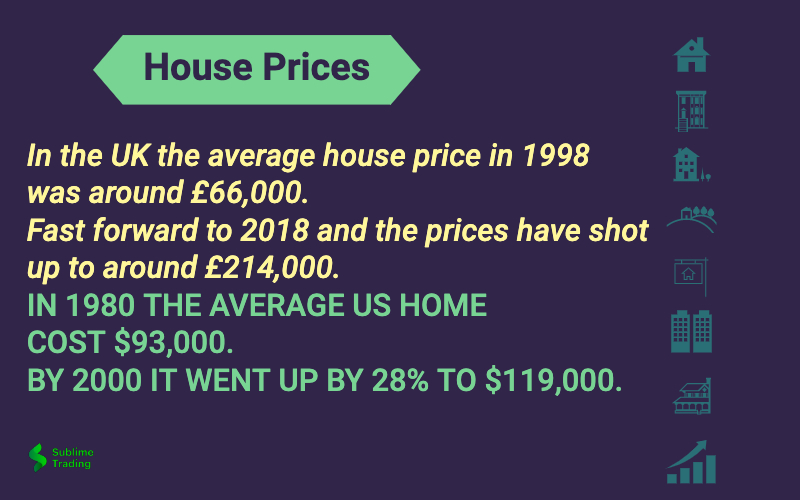

Rent

20 years ago, many homeowners could probably not have imagined house prices rising to the heights they are now.

With stagnant salaries and increasing inflation, many people won’t be able to afford to buy a property and will have to rent their accommodations, which isn’t necessarily a bad thing, but with rents increasing along with house prices, the numbers keep mounting up and so you can quite easily see why relying on a job alone is definitely not the answer to making money and funding a lifestyle.

It is just not sustainable.

4. How Budgeting can Improve Your Finances

We have gone over how expensive the world is getting, with everyday goods and services going up and institutions, such as universities massively increasing their fees and enticing us to get into astronomical debt before we have even stepped out into the big bad world of employment, we have now come to an important section, budgeting.

“Do not save what is left after spending; instead spend what is left after saving.”

Warren Buffett

Budgeting is simple to apply once learned to do properly and allows you to have a record of all your incomings and your outgoings. It allows you to clearly see how much money you need to cover expenses and what you will be left with after these expenses are paid.

This will give you complete control over your finances which is where you want to be. If you were to ask yourself how much you are spending each month, will you be able to answer this question without much thought and hesitation?

There are plenty of different software and phone applications that help you to form your own budget.

With the ever-increasing level of debt, it is very likely that the answer for a lot of people will be a straight no. If you are just spending money until you run out of available cash and having to wait for the next payday then a budget is essential for you.

It may appear like a chore but software and apps make this job a lot simpler than it used to be when we only had the option to create an excel spreadsheet budget manually.

When creating a budget, everything you spend on needs to be accounted for. When you create your budget, put your lists of expenses into needs and wants. Forming a budget is useful for the following reasons:

• It will highlight which avoidable expenses your money is being wasted on

• Informs you if you are spending more than you actually earn

• Helps to keep track of when funds may run low

• Identifies how much you will have left to save or invest each month

Your needs can be:

• Utility bills

• Food shopping

• Car insurance

• Transport fares

• Gym membership

Your wants can be:

• After work drinks

• Taxi fares instead of public transport

• Cable TV subscription

• New gadgets

• Trips abroad

Creating this type of list will make it easier to see which expenses can be cut off to increase the amount you have left at the end of each month. Depending on how long your ‘wants’ list is, savings of hundreds of pounds can be made in an instant.

If you recall the example earlier in the article regarding what can be achieved when saving £100 per month with an initial investment of £1,000, you will now be on track to achieve the same results. If you can increase your £100 contribution to a higher amount once you have budgeted then your results will be a lot higher than the £45,000 total in the above example.

With the list of ‘needs’, you can always reduce the amount you spend by shopping around for cheaper bills and car insurance. This used to take hours as we had to call every company to compare prices.

Nowadays we are just required to input our details once into a comparison website and we can scan prices from multiple insurance companies and find cheaper deals in seconds. Most people are paying bills much higher than what they should be paying without knowing. Now that searching has been made simple, everyone can and should be comparing their prices and be constantly shopping for new deals to save money.

If you have any debts, then once you have figured out an amount you can save, it may be worth thinking about how much you want to put towards your debts each month.

Paying back debts is important because the longer you have unpaid debts, the more interest is being accrued. Clear up your debts so you can start anew and everything going forward will be profit.

If your debts have spiralled out of control, are now unmanageable and you need help, then do not suffer in silence. Get on a call to your creditors and they will be more than accommodating to help you with a debt management plan.

There are also charities you can and should call to help you with this. A simple Google search will bring up a list. Yes, this will take a hit on your credit score but sometimes you have to take a step back to move forward and there is no shame in this.

Sometimes you make decisions in life that have consequences which you just have to put your hands up to, accept responsibility and use the support around you to get out of a sticky situation.

Back to your budget, you shouldn’t over-complicate it. It’s just a case of comparing what you earn with what you spend. This should be a fun activity with the aim of rewarding yourself with extra money to save and invest.

If you’re already saving then that is good but what are you using doing with the money you save? Just leaving it in the bank means you are actually losing money.

Investing is key to financial success and we will be covering how to invest successfully for healthy returns over the long run later in this article.

5. Should we be Borrowing?

Borrowing money only to have to pay more money back to your creditors is not the best scenario you want to find yourself in. However, on some occasions, it can be necessary to do just this.

In order to borrow money in the future, we must have a credit history. And in order to have a credit history, we need to obtain credit in the form of credit cards or loans if you want to be eligible for a mortgage or large loans in the future.

If you are applying for a credit card for the first time it will be difficult to get a low-interest credit card until you prove yourself to be trustworthy.

Once you’re able to get a credit card, the credit agencies just want to see that you’re able to pay back your balance each month and it also helps to improve your credit score.

Here are 5 reasons why it’s important to have good credit.

• Increase your chances of being accepted for a credit card or a loan

• Obtain low interest for credit cards and loans

• Obtain a mobile phone contract

• Acquire a business loan

• Secure certain jobs that require credit checks

A credit card is not free money, which may sound obvious, but the staggering number of people with credit card debt would probably have been grateful for that reminder sooner rather than later.

Understanding debt and the implications it can have on your finances is important and another subject which should be taught in schools. Instead, many people are unfortunately taught the harsh lesson through experience when it’s too late.

Budgeting will help you to avoid having to rely on credit cards and loans because you will be able to loan yourself the money for things you need and that way you won’t have to pay interest on it.

6. Is it Possible for you to Become Wealthy?

We have grown up in a world where wealthy people are mainly seen on TV and very rarely around us or in our neighbourhood unless you live in an affluent area. It is the working and middle-class people that we mostly come into contact with.

This is partly the reason that you may feel detached from a world where people live in financial luxury all year round, as a result, you may find it difficult to see yourselves living a wealthy life.

Mentally, it can prove really difficult to even imagine entering a world where there are 6 zeros at the end of your bank account or even just 5 zeros.

Can wealth be taught or is it something that is received at birth?

If you think about the number of social media influencers that have become millionaires over the recent years, some making $400,000 for every sponsored Instagram post, you can easily see that practically anyone has the ability to become wealthy.

Many of these influencers haven’t come from wealthy backgrounds, they simply saw an opportunity and as there is now a blueprint for success as an influencer, many are following in their footsteps and creating successful businesses.

What this should tell you is that there is a blueprint for success. If something works and you follow the steps others have taken to find success, all that is needed is to follow those exact steps and just work hard at it.

In order to create wealth, you first have to accept and believe that you are worthy of it just like everyone else who has achieved success. Money is constantly moving around us and all we need to do is discover an avenue to collect our share of the wealth floating around.

As a warning, remember the more money you make, the more debt you can potentially get into as your spending can increase to match your increased earnings. Financial education is even more important as you continue to grow wealthy.

A low earning worker may have debts of around £4,000 but someone earning hundreds of thousands a year may have incurred debts in the tens of thousands or more if they do not understand how to properly manage their money.

Professional footballers are a great example of this with quite a large number declaring bankruptcy a few years after retirement when the huge weekly salaries stop coming in but the outgoings keep going out.

When you start developing the right mindset and allow the idea to create wealth to seep into your mind you are beginning the process for wealth creation.

So now that we are all on the same page and have understood that we are all entitled to a portion of the vast amounts of money flowing around us, we can begin the process of increasing our income and creating wealth.

7. Let’s Start Creating Wealth

Now, let’s start creating wealth! There are many ways to create wealth, such as starting your own business, getting into property, or even becoming a social media influencer. It is just a case of choosing one method which suits you best.

Business Startup

If you like working with people then you may opt to start your own business that serves many customers. You get to meet lots of people each day if it is a customer-facing business and will probably work in a team environment depending on how big the business is.

Social Media Influencer

If you like inspiring people and feel comfortable being in front of a large audience then you can opt for being a social media influencer, making videos on YouTube, Facebook and Instagram and even creating podcasts.

The options are endless here as you can sell products related to the genre of videos you are making. For example, if you are a fitness expert, you can sell fitness programmes for those hoping to lose weight or gain muscle.

You may also make an income through advertising, once you build up a large enough audience for advertisers to notice your influence. Cristiano Ronaldo is reported to earn more from his Instagram profile than his salary as a professional footballer.

Property

For those of you that enjoy being hands-on, then property is another option for you. Property is a popular area for wealth creation as it is known to be very lucrative but you need to know what you are doing as mistakes can be costly.

One route people go down is buy-to-sell, where they find a cheap property below market value, in an auction for example, and refurbish the property in the hope of selling it for a profit. As with most things, there are risks involved and it is important to get the right advice before going into property.

Another option down the property route is buying a property with the aim of renting it out, also known as buy-to-let. This is where you buy a property in order to rent it out for a monthly income which should cover the mortgage and allow you to make some profit on top.

Having a few properties can bring you in a monthly income that covers all your expenses plus a lot more. This will mean that you are now financially independent and you can start to really enjoy life as you have the option to spend your days doing the things you love.

As well as renting your property out, the actual worth of your property may increase over time and you can even sell it in the future for a profit.

Just remember that volume is not as high as people think and that selling a property can be a frustrating and long-winded process.

Investing

The next option which has been growing increasingly popular over the years is investing in the financial markets.

This option is suitable for people that want to make money in a field that doesn’t require a lot of their time allowing them to continue earning money in their jobs and what they are good at. They simply then need to leverage and compound their money through the financial markets.

The challenge is finding someone that is credible to learn from as the internet has become a platform for marketers to position themselves as experts. There are many online coaches selling and luring people onto their forex day trading courses through the promise of quick riches.

This is high-paced, risky, stressful and requires endless hours in front of the computer. This is sold as the sexy way to make money and the dream lifestyle but in reality, is how many novice traders lose money fast. This is how dreams are shattered and taken from you. This is NOT the avenue you want to go down.

You want to have a much smarter approach and go down the route of learning to be an investor. This is much slower paced, requires an hour of good weekend preparation and only a few minutes a day during the week.

It is far less risky and although it may not sound as sexy as day trading, the returns are far more consistent and lucrative over time through the power of compounding and this is the real sex appeal that day trading will never afford you.

Now, the time commitment involved may seem remarkable, as the idea of making lots of money with little time and effort is unheard of, but this really is the case as allowing your investments time to grow with little tampering is the key to wealth creation in investing. You can learn more about this by learning these 5 steps to beginning your financial education.

The popularity of investing is partly due to the fact that it can be done from anywhere in the world. All that is required is a laptop, a good piece of trading software and an internet connection. All ventures require the right tools for the job and investing from home is no different. We go into more detail on our free 4-part training series.

Stocks are a common type of financial investment and you can learn how to make money when the market goes down as well as up by learning to buy stocks in 5 simple steps.

Forex trading, also known as the foreign exchange market, has grown in popularity since 2010 when I began trading, as it offers traders the ability to make fast profits from price changes in currency pairs from different countries.

There’s also the option to trade commodities such as Gold, Silver and Palladium which has seen investments soar over the years with Gold increasing by 566% from 1998 to 2011.

It is important to note here that do not get caught up in the misconception that “trading” means only short term which is often the case. Trading just means to look at charts whereas investing traditionally means to look at news items to make your investment decisions.

However, you can also use charts to make long-term investment decisions making this combination a powerful approach for private investors which we cover in detail in our free 4-part training series.

Pensions

Having good money to live a stress-free retirement is very important. I am sure you do not like the idea of spending decades in employment only to find out you still need to continue working when you are ready to retire just to survive financially. This is where saving and investing comes in.

A pension is simply a pot of money which an employee funds each month from their salary, which is invested over the years through a pension provider. Upon retirement, the fund should have grown to a certain amount, depending on how much was invested and when the pension was started, and then paid out, either in a lump sum or in segments, to the former employee.

Some employers also contribute to their employee’s pension fund, increasing the amount in the fund further.

There are concerns, due to the current state of the economy, that pension funds may not be able to fulfil their obligations and worryingly, in the years to come, many retired workers may find that there is no money in the pension pot and may find themselves having to work past their retirement age.

Whether this may be the case or not, waiting for retirement to find out whether you will have an income is a gamble and a huge mistake so it is important to put the control of your financial future in your own hands.

SIPP

In the UK, A self-invested personal pension (SIPP) gives you more flexibility with the investments you choose. With a standard pension, your fund is managed by the provider but with a SIPP you can choose your investments and manage it yourself or you can pay an investment manager to choose your investments.

SASS

A small self-administered scheme (SASS) is similar to a SIPP but they are usually individually established by the directors of a company and costs more to operate this pension scheme. You also have the flexibility to choose your investments.

ISA

An ISA is an Individual Savings Account available to residents of the UK and it allows you to save tax-free up to a maximum amount of £20,000 at the time of writing but this figure does tend to change for each tax year. You can invest a monthly maximum of £1,666 without exceeding the yearly maximum of £20,000.

There are 5 types of ISAs for Adults:

• Cash ISA

• Stocks and shares ISA

• Innovative Finance ISA

• Lifetime ISA

• Help to Buy ISA (closes to new savers from November 30th 2019)

There is 1 ISA type for children:

• Junior ISA (for under 18’s)

Some facts of ISAs:

1) You have to be over 16 for a cash ISA, and over 18 for the other 3 ISAs, but under 40 for a lifetime ISA.

2) You don’t pay interest on a cash ISA.

3) You don’t pay income or capital gains tax on investments in ISAs.

We will just be focusing on cash ISAs but more so on stocks and shares ISAs as these are the most popular ISAs and relevant to creating wealth.

Let us say you were to have the full £20,000 for the maximum ISA allowance and were to add this sum to the cash ISA. The average interest you can find for this account type is 1.5% AER.

After a year your account should have accumulated £300 in interest bringing your total to £20,300. With your money sitting there doing nothing, this is not too bad and over the years, with compound interest, you can make good profits with little to no work.

If this satisfies you then you can stop here but if you would like to earn more with only a little extra work then you will be interested in the stocks and shares ISA. As you have more flexibility over your own investments, you have higher earning potential and there is no set amount on the potential interest you can gain.

If your investments double over the course of the year then you would have made a 100% profit. Even profits of 10%, which is not uncommon, beats the cash ISA which is why we prefer the stocks and shares ISA.

For those of you that want to take investing to the next level and if you live in the UK you might want to take advantage of another tax-free tool called spread betting. We are hugely fortunate to have this here in the UK for us to take advantage of as it is not available in many countries around the world.

With normal investing, you buy the actual shares in a company and will need the exact amount of money available to buy the number of shares you wish to purchase.

For example, at the time of writing, the price of JD Sports Fashion share were £7.58. If you wanted to purchase 100 shares it would cost £7.58 x 100 = £758.

With spread betting, you only need a fraction of this amount. Instead, you are betting on which way you think the market will move. Price movement up or down is measured points in stocks and commodities and in pips in forex.

You place a monetary value per point/pip for an instrument and then choose a direction, either up or down based on your analysis.

If your analysis says Apple will move up, then you can, for example, choose £1 per point. This means that for every 1 point that Apple moves up, you make £1. If it goes against you, you will lose £1 for every point.

Now do not be fooled or put off by the term “betting” in spread betting. This is just a name for a type of broker account. The benefits and functionality within a spread betting account, however, are powerful and life-changing and I again why it is worth repeating that we are very fortunate to have them here in the UK.

Some of the benefits are:

They are leveraged accounts which means you only need to put up a fraction of the amount as opposed to the whole amount needed as explained in the example above for a traditional broker account or a stocks and shares ISA. This means you need far less money to get started.

Spread betting accounts offer leveraged access to a wide variety of asset classes meaning you can get exposure to the most lucrative instruments from around the world that was once not possible and only available to the very rich.

Spread betting accounts have excellent risk management features so if you want to lose no more than 2% per investment then you can set that in your account. Leveraged accounts give you a lot of buying power so of course, there are risks involved and so you can end up losing a lot of money and fast which is what most day traders end up doing. It’s based on greed and not how you would do it as an investor right? You, instead, a far smarter and want to learn to invest correctly and understand how to manage risk!

We go into a lot more detail in our free pdf on 9 Questions on how to Choose the Right Broker.

If you really think about it, when you are investing in the financial markets, increasing wealth is merely increasing the amount of money you already have over time.

Going back to the idea of compound interest, this is something that is inevitable as long as you have your money in an investment vehicle that can consistently produce profits which is not too difficult to find these days. Some vehicles simply give you the opportunity to compound faster and larger than others!

Once you find a good vehicle to place your money in, it is now just a case of allowing the magic of compound interest to kick in.

If you were to ask if getting rich overnight was possible for anyone, our answer would be not very likely. But if you were to ask if it were possible for anyone to become wealthy over time then we can confidently say YES!

With the right knowledge, this is very achievable. What is required is discipline and resilience to follow your investment rules and patience because it can take time.

Even if you were to start with a small amount, your account will grow, it will just take longer than someone with a larger account.

You stand a greater chance of making a lot more the larger your account and if you increase your monthly contributions to give yourself the foundation to reach that elusive goal of a million a lot sooner.

The example shown demonstrates what is possible with a very small amount when you apply patience. The key really is to get your finances in order and saving from now if you have not already.

And if you do already have a decent savings pot then your goal is to get clued up and to get investing from now using the vehicles mentioned above.

Time flies, that goes without saying. One of the biggest tricks the system plays on everyday people is to think they have time. You do not.

You really need to sit down and think about where you will be in the next 5 years and beyond if you continue to mismanage your money like the majority of society compared to where you could be by getting just a little smarter and aware of the options available to you and becoming savvier with investing your money.

Life is no doubt getting harder and more expensive but the tech-age we live in has opened up a wealth of opportunities that were once upon a time available to only the rich. This is now a level-playing field and there has been no greater era to generate wealth for the everyday individual.

You just need to put into place the steps to stake your claim to take back control of your’s and your family’s future wealth.

Keep it simple, keep it Sublime!