Learn how to put investing together like the pieces of a puzzle.

Do not fall into the trap of thinking that The Holy Grail in investing exists. It doesn’t. There is not one thing that is going to make you rich overnight. Forget thinking that only using RSI or Fibonacci indicators are the answers. Look away from the over-simplistic approach of a doji at support or resistance as the answer.

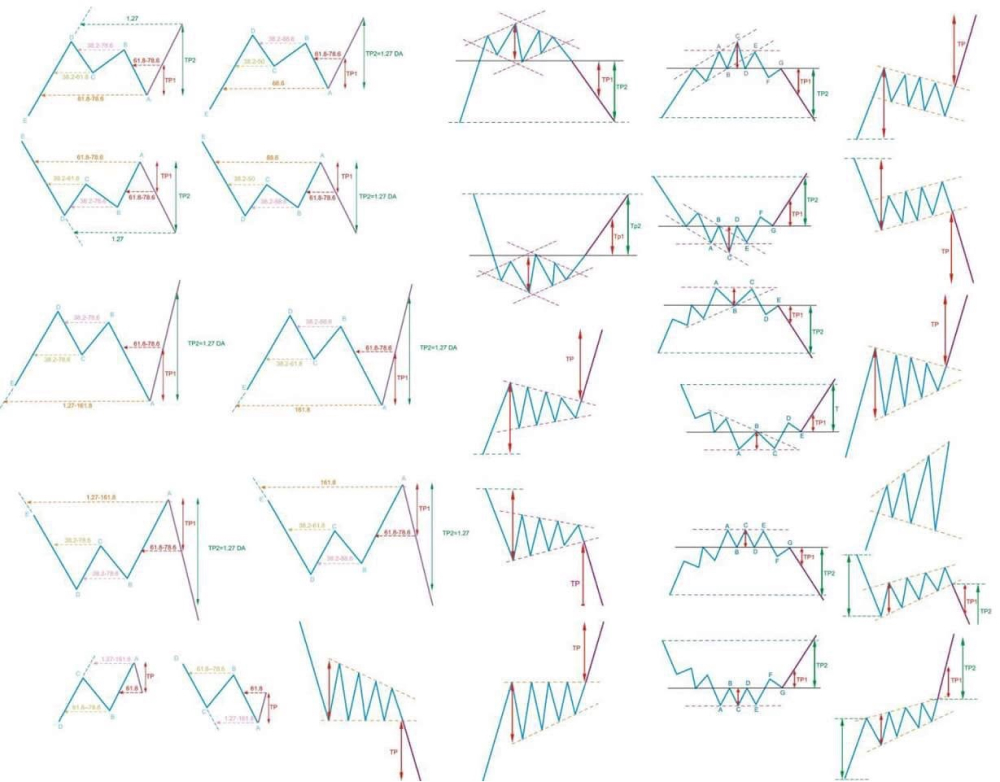

Take the image above of various chart patterns. Being able to identify them is one aspect of investing but it is a whole different ball game knowing exactly how to use them. Identifying and investing on a single chart pattern is just not enough.

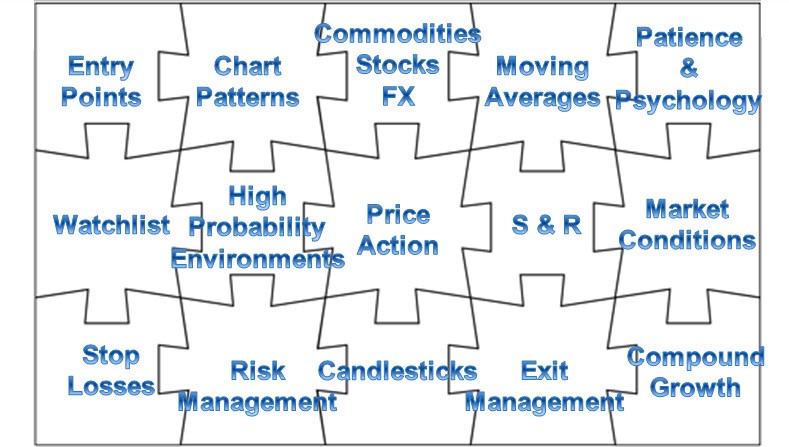

Investing is far more sophisticated than that. The best way to view investing is like a jigsaw puzzle with various pieces that need to be put together to make the complete picture. Each piece of the puzzle will have its own set of strict rules of application in order to remove subjectivity. They work best when kept simple and are actually not difficult to learn. This is not rocket science or brain surgery but investing certainly needs far more respect than most people give her.

First of all, people need to understand that technical analysis (TA) and investing go hand in hand but that TA and investing are not one and the same. TA is simply breaking down a chart into patterns and levels. It is looking at the history of a currency, stock or commodity and determining levels that price could move towards in the future by building a bias to price action. Investing, on the other hand, is the application of various strategies to your TA to extract consistent profit from the market. A technical analyst is not an investor but anyone with the right approach, mindset and investment can learn to be a highly-proficient investor.

Let’s explore this concept further and break down the differences between TA and investing.

TA involves understanding the following elements:

-

How to read price using multiple larger time frames.

-

How to group and use candlesticks as either indecision or reversals.

-

How to group and use chart patterns for either a trend continuation or a trend reversal.

-

How to recognise important levels of support and resistance on the yearly, monthly, weekly and daily time frames.

-

How to use last year’s annual levels to give price a bias.

-

How to use moving averages to give price a bias and to recognise trend direction.

-

How to use on-chart indicators like Bollinger Bands and Donchian Channels to build an edge in the market.

-

How to use the right subcharts indicators to add to the edge.

-

How to recognise that the weekly and daily time frames are moving in the same direction.

-

How to recognise a trending market from a consolidating market.

Many of the readily available concepts of TA such as Elliot Waves, RSI, Stochastic and Fibonacci Levels can work, however, we as private investors, are now far more sophisticated both in our approach and the tools we have available to us. Like all industries, there is a certain level of evolution involved and investing is no different. The market moves and has always moved in a certain way. We are now better equipped at adapting to it and making money.

NOTE: Free software can work and is a good place to start but we now have the ability to create more sophisticated tools that do much of the manual labour for us.

Investing, in comparison to TA, involves understanding the following elements:

-

Being able to identify whether the money is in FX, stocks or commodities.

-

Managing a watchlist and portfolio by moving between trending and non-trending instruments and and not having attachments (Your attachment should only be for as long as you are being paid!).

-

Waiting for the most optimal entry points into high-probability environments.

-

Applying patience and standing aside when markets are not favourable.

-

Being able to identify what trend structure you are dealing with.

-

Knowing, out of your arsenal, what strategy to use in the appropriate market conditions.

-

Knowing how to allocate and manage risk per investment, per day and per max risk of your account(s).

-

ALWAYS using and knowing how to calculate and manage stop losses for each strategy you have.

-

Knowing which method of compounding is most appropriate for the trend structure you are dealing with.

-

Knowing how to calculate trailing stop losses and managing your exit from the investments.

-

Being able to detach yourself from the investment and instead having an unemotional approach.

-

Embracing the fact that price does not move in a straight line and expecting moves against you (allowing you to compound!).

-

Allowing your winning investments to run for weeks and months by holding through pullbacks and breather periods.

-

Cutting your losers short, not moving stops and accepting that losses are part and parcel of investing.

-

Focusing on capital protection and not profit.

-

Thinking in terms of risk to reward and random statistics.

-

Thinking in terms of profit and loss and not winning and losing.

-

Putting ego aside and not investing on fear, hope or greed.

-

Making informed decisions based on what price is telling you alone and ignoring the news and others’ opinions.

-

Being consistent in following your rules.

In short, TA and investing are used in combination to:

-

Identify where the money is.

-

Identify a high-probability setup through a well-defined edge.

-

Know what trend structure you are dealing with.

-

Apply the appropriate strategy with a small risk.

-

If it fails get out via a well-placed stop loss.

-

If it moves into profit, compound appropriately.

-

Manage your exit according to what price is suggesting in accordance to support and resistance.

-

Until the money is identified, stand aside and protect capital.

-

Be robotic with your approach at all times.

These are the pieces of the puzzle that make up investing. They all need to be there and equally respected. As already mentioned, these are simple to understand and to follow but it takes some time to perfect (months with good training) and requires investing.

Look away from investing as a get-rich-quick scheme but instead as a business that can empower you with your money and your time.

As always, keep it simple, keep it Sublime!