Warren Buffett is known for saying “Be fearful when others are greedy and greedy when others are fearful” and this has been proven to be true countless times since the dawn of the markets. Wise words from a man with over 60 years of investing experience and a net worth of over $80 billion often overlooked in preference of what is shared on social media and news channels.

Declines in the market have always offered smart investors the opportunity to make significant profits but many run in fear based on what they are told on the news and what they choose to believe and as a result, never get to experience these profits.

Opportunities to profit from sudden declines in the market come by frequently and the recent declines are evident of this.

Ultimately, the financial markets play a big part in all of our finances, from our pensions to our savings and so it is important that we know how to protect our money during major world issues whether they be political, financial, economical or health-related.

It is said that the virus originated in the wet markets of China and has since spread globally with new cases appearing in Italy, Canada, the United States and the United Kingdom to name a few.

With growing fear, it is inevitable that at some point this was going to be reflected in the financial markets. Last week saw some of the largest declines in price in recent history which is naturally being pinned to the spreading of the virus.

The coronavirus was the catalyst resulting in a 10%+ fall in a single week which has made it one of the steepest vertical drops in the history of the markets.

Now declines in price are commonplace and for those who are familiar with the natural cycles of the markets will know that short-term reversals, also called pullbacks and corrections, are known to occur at this time of year. These are often slow, unremarkable and expected by seasoned investors and so well-managed through risk-management, stop-losses and patience.

However, the declines of last week were swift, aggressive and very unexpected, even for the seasoned investor, and which is why the news was filled with panic. But do we expect anything less from the message spewed out through our television boxes, radio airwaves, printed and online media?

At times like this, it is imperative to remain calm when your finances are on the line as you do not want to be panicked into making a brash decision which you are very likely to regret a little later on when the dust settles and ‘normal’ news resumes.

The reality is that when a market drops as quickly as it did last week, it often finds a level to bounce back up off, known in investing terms as a support level, followed by a move back to the upside which tends to be equally as quick as the preceding decline. Price then settles back into its normal market rhythm.

The move back to the upside presents investment opportunities that were once upon a time open to just a select few.

The internet is a wonderful tool that has levelled the playing field and now allows us, the private investor, to take full control of our finances and to position ourselves to manage and leverage our investments further.

However, it is due to a school-education-based lack of financial literacy that prevents people from doing so.

Currently, there is uncertainty over the global economic impact the coronavirus will have and investors in the markets are grabbing their capital and running with fear which is understandable especially with the 2000 and 2008 financial crises etched in memories.

However, if we stop and take a moment to reflect on past events, over the years we have been here many times before with analysts finding reasons to call the end of the markets and the start of a global meltdown only to be proven wrong time and time again.

The chances are they will also be wrong about the coronavirus.

One question that often comes to mind is how is it that there are always a select few that not only manage to protect their capital but also manage to see huge additional growth?

The answer is that smart investors go against the crowd and the herd mentality and instead follow the path of the ‘smart money’.

So then the next question is how are the smart money positioning themselves right now?

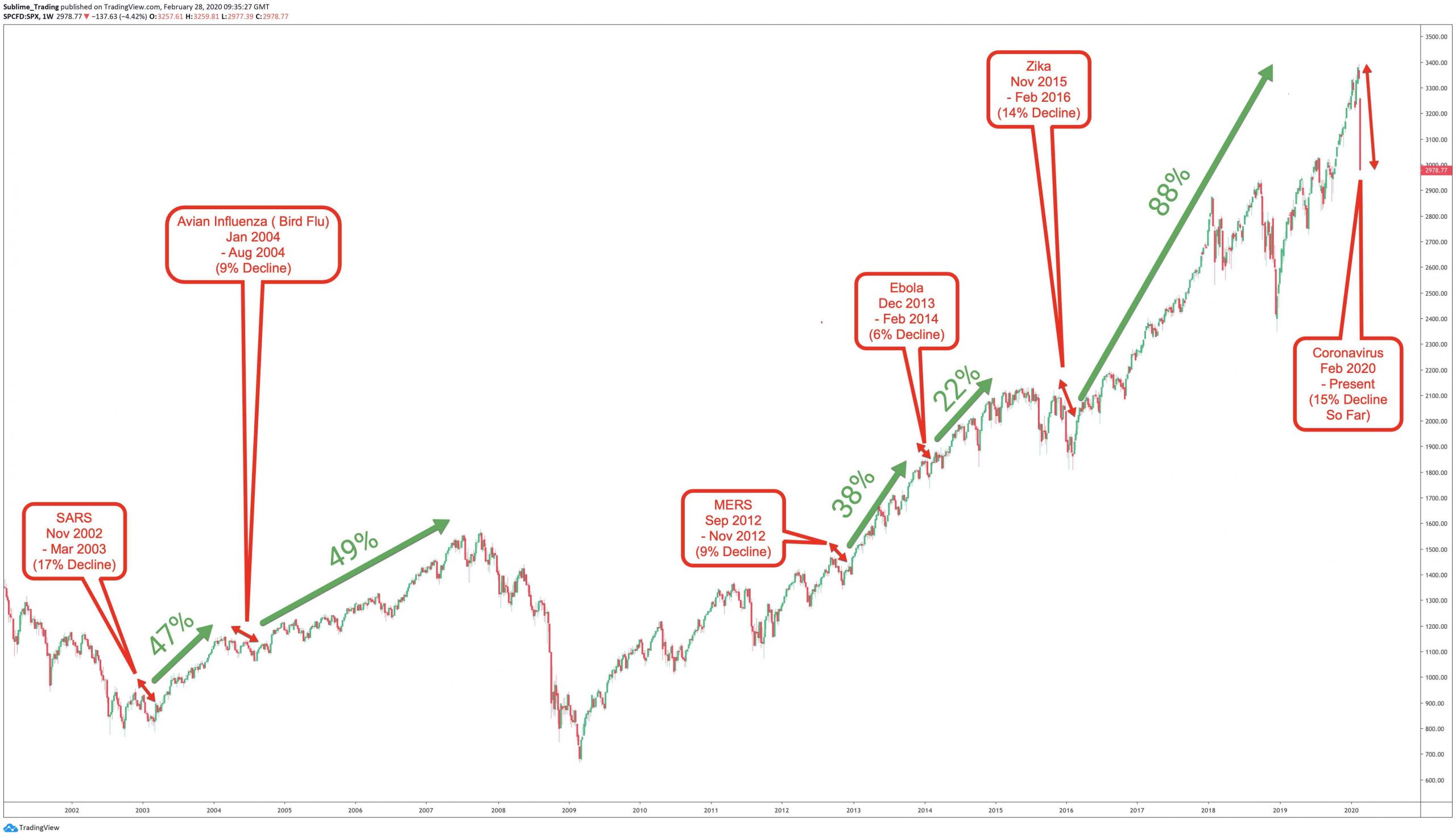

The chart below could have the answers. It shows previous health epidemics that we have had to witness through the eye of the media and the resulting trends that followed.

What we can conclude from this chart and these historic events is that the bull trend simply resumed after a period of time.

By understanding this and applying patience meant you would have been presented with opportunities to invest during the recovery phase of the market that would have led to further long-term growth on your finances.

The rise of the bullish trends that followed the initial market decline ranged from between 22% and 88% which are significant moves resulting in excellent returns.

What happens during stock market declines is that stocks fall to a cheaper level where they usually form a base which we called a support level earlier.

Understanding how to read past price action in the form of charts – known as technical analysis – allows us to determine in advance where that base is likely to form and which is where investment opportunities form.

And this is exactly where the smart money take action.

Timing and patience are key and both key skills of good investing.

There is always the risk that the market will decline further so experienced private investors let the market dictate the start of a recovery before making any investment decisions. The start of a recovery is a sign that institutional money is coming back. Private investors look for this directional volatility to then jump in and piggyback the ride.

Here is the chart for JD Sports which has found a base and support at the daily 200 simple moving average.

Here is a chart for Marsh & McLennan Companies which has found support at the daily 200 simple moving average and a previous high, from the high of July 2019, which was a resistance level that has now turned to support.

(A resistance level is the opposite to a support level that causes price to move from up to down. When a resistance level is broken it becomes a support level and is a strong sign of further moves to the upside.)

These are just 2 examples of many stocks that are finding their feet amid all the volatility. We now need to apply patience and let price dictate a recovery as there is always a chance of further declines.

If the market does keep on declining, then again, not all is lost. Good investors will change their stance from bullish to bearish and will look to short the market when the time comes like we would have done in 2000 and 2008.

However, the news and analysts should very much be ignored as we are a long way off from this happening just as yet. We are still very much in a ‘corrective’ phase of the longest bull run in history.

Here at Sublime Trading, we have developed and trained our members on bespoke investment tools that help us to quickly determine if we are in a bull market, a bear market or a consolidating market and to then position ourselves accordingly.

Understanding market conditions is pretty straight-forward, the best techniques are simple but it is extracting profit through the various cycles that is a challenge for most as well as dealing with these rare moments of added volatility brought on by freak world events.

The goal of this article is to drive home the importance of being financially literate as well as understanding why it is imperative to know how to manage your investments in all market conditions.

Ultimately, only you are responsible for yours and your family’s future wealth and so learning to separate the person who watches the news from the person who manages the family fund will do you far better in the long-run.

Any concerns or questions you may have regarding the recent events in the market, engage us in conversation via our facebook group.

Keep it simple, keep it Sublime!