‘Compound Growth Is the 8th Wonder Of The World. He who understands it earns it. He who doesn’t pays it.’

Regardless of whether the great man Albert Einstein said this or not, there is undoubted truth to this. Compound growth is ‘the secret’ to wealth. Over the decades, the best investors and traders have embraced compounding with little hesitation and achieved mind-blowing figures in the process. We must do the same.

There is absolutely no need to reinvent the formula, which is often the case with day trading and its variation of short term approaches and why they don’t work. Instead, take what is proven to work and get it working for you. Good investors are good at KISSing after all – Keep It Simple Stupid.

If we flip the script for a second, someone who has ever experienced debt that has spiralled out of control will know what it means to experience compound growth working against them. This is a soul-destroying place to be.

If this is where you are right now, we highly recommend seeking professional help to get this under control. Here in the UK, there are charities set up to guide you on managing your debt. Hopefully, you have a similar whichever part of the world you are in.

This is a tricky spot to build from, but it is certainly not impossible to work your way out from a build a happy life of abundance; however, you choose to define that. It will take some strong choices, patience and resilience.

Sometimes, we need to step back to step forward, and there is no shame in that. The lifestyle created is one where we continuously have the compound growth process working in our favour effortlessly and efficiently.

I will now get you to do a quick exercise that is rarely done but is an essential step in reaching your desired wealth target before or by retirement.

The chances are you already have savings in place. You may also have a pension, an ISA, a SIPP, or any number of other investment options in place. You may have also taken this one step further and created a stocks and shares portfolio.

If you have one or any combination of the above, then that is a solid start. Well done! You understood that you and only you are responsible for making your money work for you. You are probably aware that however you have distributed your money, it can be performing better, possibly a lot better.

Given the foundation you have put in place, you need to figure out how on track you are to achieve your desired wealth target by retirement.

To work this out, it will involve you answering the following questions:

How much you currently have in your savings and investment portfolio?

What is the desired wealth target you plan to achieve by retirement?

How much further can you contribute per month or year?

In how many years do you plan to retire?

With these answers, you can calculate the exact annual ROI your investments on average need to achieve to hit that desired wealth target. We call this number ‘your compound number’. Doing this exercise will also indicate how on track or off track you currently are to reach your retirement goals.

You will be happy to know that we have done the hard work for you and created a spreadsheet that works out the ROI for you after inputting the required answers. Click here to download it and take a moment to work your compound number out.

Here are some examples of the exercise:

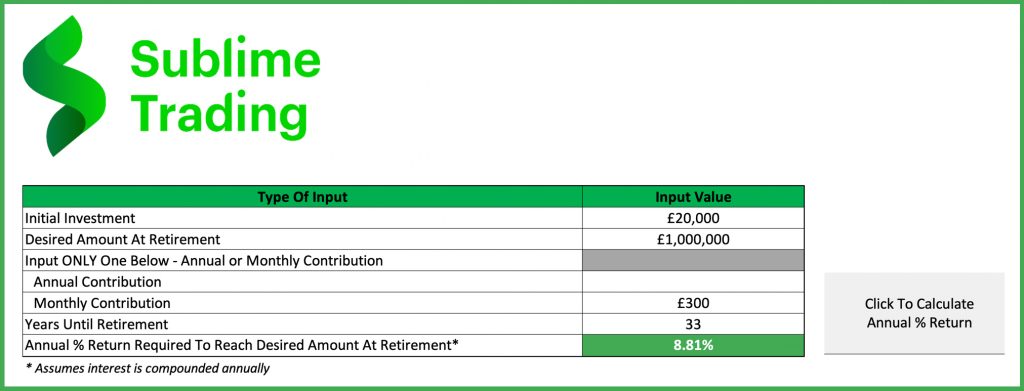

Example 1:

- £20,000 in savings and investments

- £1,000,000 desired by retirement

- £300 monthly contribution

- 33 years until retirement

- 8.81% ROI needed

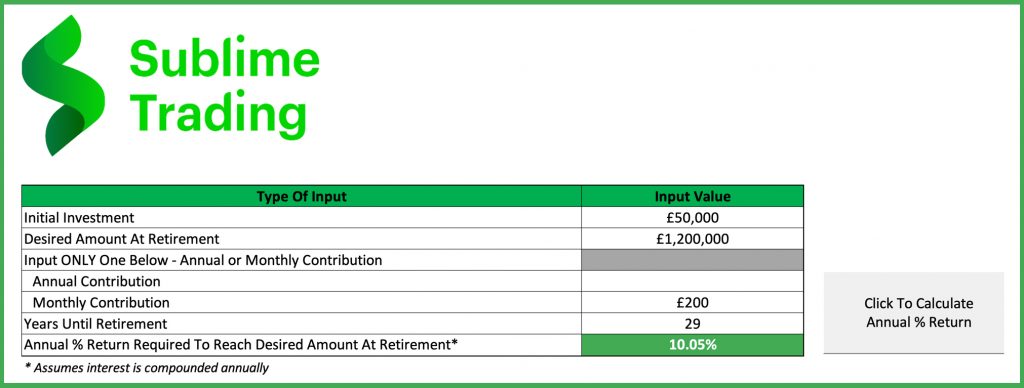

Example 2:

- £50,000 in savings and investments

- £1,200,000 desired by retirement

- £200 monthly contribution

- 29 years until retirement

- 10.05% ROI needed

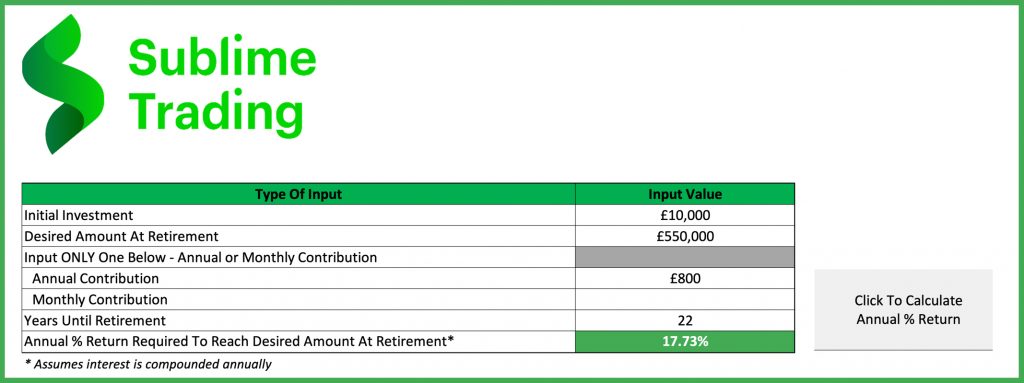

Example 3:

- £10,000 in savings and investments

- £550,000 desired by retirement

- £800 annual contribution

- 22 years until retirement

- 17.73% ROI needed

The examples above will drive home the importance of doing this exercise. It will be an eye-opener for many. Knowing exactly where you are right now and how your investments need to perform going forward will guide you towards making the right choices and changes if you are to retire wealthy.

If you are on track, then keep doing what you are doing. As we proceed, we will teach you a specific way to speed up the process dramatically or increase that desired wealth target significantly. If you are not on track, we will show you how to lay the groundwork to do a 180 on your current stance and move forward with stealth, confidence and peace of mind.

In short, this involves a combination of using leveraged accounts safely and compounding your returns year on year. When done correctly, this is an unbeatable combination for us as everyday people. For UK residents, your returns will also be free of capital gains tax. That in itself is a reason to adopt to learn and master this approach.

Below is a table of results we have achieved since 2007 using leveraged accounts and compounding. We will go through the specifics of exactly how we achieved this in the following articles. But, for now, there are two main points to grasp:

- A good investor follows that natural flow of money between markets.

- There are opportunities near enough every year to capitalise on.

Based on this table of results, had you started with £20,000 in 2009, your returns will have grown exponentially to £2,500,000 in just 11 years. That is the wonder of compound growth.

The first time you experience the formidable combination of leveraged accounts and compounding, investing takes on a whole new outlook. It is simple, efficient and brilliant.

The challenge is that many never give themselves the chance to experience it, opting for lesser approaches or just not being resilient and patient enough to allow the compound growth effect the time to kick in.

Good investing is far more than doing some basic analysis and buying an asset. This is a sophisticated art that the ego often fails to put any appreciation on.

- Which asset class – stocks, commodities, currencies, cryptos – should you be investing in right now?

- Which assets in that asset class should I have in my portfolio?

- When is the optimal time to enter into the asset?

- How much should you risk?

- What is the exit strategy?

These are questions you must need the answers to each and every time you risk your hard-earned money making an investment, ensuring the odds are ALWAYS stacked in your favour, questions that are actually very simple to answer with some good education.

However, The unsophisticated investor often leaves these answers to chance. Those opting for stagnation will believe there are no answers or they are too difficult to learn. Our advice is to not be so defeatist.

Believe in your potential. Granted, it has become tough to filter through the internet for credible sources, but what you need to learn and execute is straightforward.

And the great news is, the endless searching stops right here. What you seek, I will unveil piece by piece. Now you know your compound number, let’s move forward with the journey and work out how to achieve this.

Main Take-Away:

- Lesson 1 – Save at least £10k to £20k to give yourself a solid foundation to build from. This may require sacrifices at first but as you earn more and save more, the balance of the ‘having a life/saving money’ dynamic tilts in your favour.

- Lesson 2 – Looking at charts as a trader but holding positions for extended periods as an investor is the most complete approach for us as everyday people.

- Lesson 3 – Protect yourself from misguided and ill-informed opinions by becoming financial literate. Only you are accountable for what you achieve by retirement.

- Lesson 4 – Financial literacy means knowing precisely what you need to know to make as much money as possible as safely as possible between now and retirement. The rest is noise.

- Lesson 5 – There is no need to reinvent the formula. Instead, play the long game and embrace compound growth. Calculate your compound number to know exactly where you are on your investment journey. This will help you move forward with stealth and confidence.