IAG Shares – What is going on and what should I do?

As we know, IAG currently have a shares/rights situation going on, where current shareholder has the chance to buy some more shares at a discounted price.

Yes, you have the chance to buy more shares, but this time, even cheaper than new buyers can get them at. How kind are they for rewarding loyalty like that. I know, this sounds great, right!

“Gio, get it together man – Obviously by buying more shares in IAG, this would mean that I am averaging down my overall share price, which can only be a good thing!”

Yes, averaging down the price is a technique a few people use, depending on their situation and what their end goal is.

I totally get that nobody likes to see any of their stock go down and the mindset of quite a few traders is one that they want to see all the stocks in profit, even if it means buying more stocks in a company as the stock price is plummeting down, so that it looks better on their screen and less of a loss.

In the case if IAG, we know that they are trying to raise funds so as to stay afloat, and judging by the current climate, we also know that we are looking at possibly a few years before we start to see some serious improvements and ones stock come into profit, or break even.

Ok, I am unaware of your trading style, so I will base this on a Trend Trading methodology.

One thing to bear in mind here is that a trend trader would be using stop losses, so a stock should never drop to such depths as 50% or so within their portfolio. If it did, then there is something wrong within their trading setup.

But I never used this technique, where do I go from here?

That aside, let’s say you bought this on 31’st Dec 2019, what are the possible options for one that is currently in this stock, now?

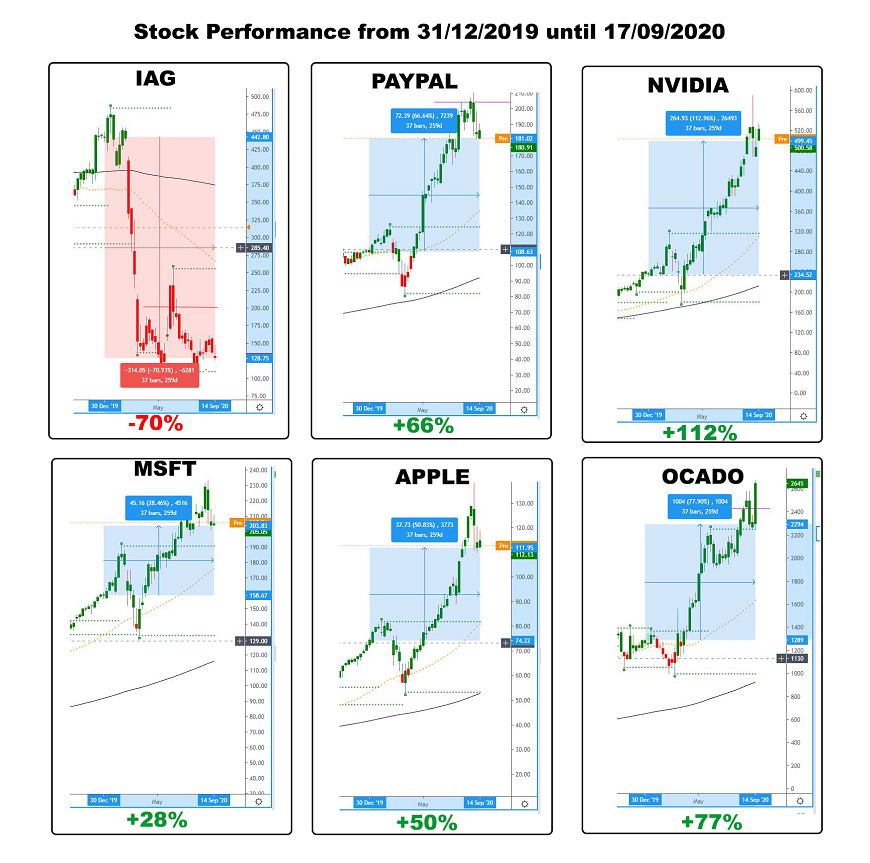

Well, if we bought it then, we would know that IAG has dropped around 70% in that time…. (I know, that hurts)

OPTIONS:

1, Hang onto the stock, in the hope that it will rise in 3 or 4 years and we can at least break even.

2, Buy more shares, averaging the price down, again, in the hope that it will rise over the years and we can at least break even.

3, Buy into the shares/rights and get some at a discount price, AGAIN, in the hope that it will rise and we break even.

Chances are, we may fit into one of these categories, and of course the last option does seem the most feasible in the current situation.

What about option 4?

4, Instead of investing into buying the new shares on offer, we invest the money into something more sustainable and a company (or companies) that in the long run could see us better off than all the previous options.

Let’s say that on 31’st Dec 2019, you bought £1000 worth of IAG shares.

We know that these have dropped around 70% so our £1000 is now worth £300

We now want to put in another £1000 so as to average down our price, but instead of putting it in IAG, we put it in Apple. Now we know that since the beginning of this year, Apple shares have risen around 50%, so this would have meant that our £1000 is now worth around £1500.

Yes, overall, we are still down, but this now means that our -£700 loss is now only -£200, in the space of 9 months… (that is, if IAG stay at their current -70% down, if it goes lower, then obviously our loss would be a little more)

Let’s do the same with PayPal – Our £1000 stock would have gained 66%, so our £1000 investment is now worth £1660 meaning that our -£700 loss is now -£40 loss in 9 months… (Again, that is, if IAG stay at their current -70% down, if it goes lower, then obviously our loss would be a little more)

As for NVIDIA, well, believe it or not, we would actually be in profit, even with the -70% loss from IAG, as NVIDIA stock went up around 112%:-)

All the above is based on £1000 placed in the stocks at the same time, and yes, I know I have oversimplified the matter.

I am not telling you to sell all your IAG shares as like I said further up, I don’t know how you trade, but what I am saying is that, as we have no idea how long it will take them to bounce back, and even if they will bounce back anywhere close to their old heights, it may be more cost effective to look into stronger trading stocks and invest in those instead of considering cost averaging, as we may be better off in the long run.

The golden rule is – DO NOT ATTACH ANY EMOTION WHATSOEVER INTO A STOCK AS THIS SERVES NO PURPOSE OTHER THAN TO AFFECT YOUR TRADING JUDGEMENT.

How many times do we read comments from people saying…? “It’s ok that my stock is running at a loss, as over the years, it is going to pick up and we should be fine… I am playing the long game”

If one says this, I have a few questions…

1, WHY?

2, Do people seriously think that it is better to wait on a stock (depending on the situation) for years in the HOPE that it will rise?

3, Could it maybe be a better option to work on and concentrate on higher performing stocks and not keep adding to one’s current struggling stock?

4, Shouldn’t we have a strategy in place so that this sort of thing won’t happen again and a stock NEVER falls to around -30% to -70%?

I have listed a chart that shows a number of stocks against the IAG stock as this will give a visualisation of what options there are out there…

Remember, no matter how far down we are in the IAG deficit, there still is a way to climb out of this current hole. The trick is in knowing the best option.

I am more than happy to point people towards the methods I use, when and how I use them, if interested. Just drop me a pm as I am not going to turn this huge War & Peace novel…

I hope this can help a few people see that even though the IAG situation may seem bleak, there are ways of improving things and coming out of this on top