What is your daily routine on how you trade?

We all have our own ways of trading and deciding what stocks to buy into

This is just to give people an idea of how my day goes. Granted, I could be doing it totally wrong, but no complaints so far

09:00 – I scan over the companies I am currently trading. Takes around 5 minutes. Could be done in 1 or 2 minutes but I like looking at charts, so I take a little longer.. (I’m a bit nerdy like that)

09:05 – I log in and see that the fairies have sent me a list of 69 companies for me to analyse and see if any of them are worth trading… No, I haven’t lost my mind (yet, lol!) The team I work with sends out a few lists a week of strong trending stocks and a group of trend traders analyse them. Today’s list (21/10/2020) contained 69 stocks.

09:10 – After downloading and importing, I will now scan through all 69 in 7 minutes.. Ok, it could have been 8 minutes, and no, that is not an exaggeration.

Out of that list of 69, I have marked 5 potentials that interest me and I will watch. I mark them all as Amber within the list so that they stand out.

09:20 – (I know I said 8 minutes and this is 10 minutes, but I may potter for a few minutes).. Then I go make myself a coffee as I have just scanned through 69 companies and I deserve a break

09:35 – Go back over the 5 companies that caught my eye and whittle that list down to 2 or 3.

09:50 – Make a note of the remaining 2 or 3 companies, or, if I can’t whittle the list down as they are all potentially good trades, I will then list these on the trending community as I would like the opinion of other like minded people (other trend traders) to see what they think.

Note: Best way to do this is to just list all 3 or 5 and just see which ones they would go with and why… (I don’t just want a choice, I want a reason why they made their choice and they all give their reasons, which is something I like)

ALSO: – Bear in mind that all in the trend trading team have the same list provided to them so it is good to see if we are all on the same wavelength.

10:00 – Go through emails, answer important ones and delete a load as there always seems to be some spam!!

10:10 – I have a few emails also from certain companies that enjoy giving tips on what they think is going to do well. To a trend trader, this is classed as noise as we follow chart patterns and not fundamental analysis, but I quite often let my curiosity get the better of me as I want to know why they chose these companies. I run them through my bespoke trend analysis software. More often than not, they fail my tests, but sometimes, the odd one may pique my interest and I may mention it to the other trend traders to analyse.

10:30 – Surely it must be breaktime! If it isn’t, I deserve a break after all that work I’ve put in – lol!

I now get on with the rest of my day, be it going to coffee club (outdoors of course), or sort out my other non trade related work.

I also log in to this forum, read and try to answer any questions (if I can).

15:00 – I will see how others have answered the questions about the stocks and maybe add them to my watch list so as to choose the right time to step in and trade them… (tbh, this is also discussed so basically the other traders have done my homework for me)

All the above took on average around 1 hour 15 minutes, and that is only because I was pottering a little. A properly taught trend trader should be pulling all that in well under an hour per day, some within 30 minutes.

My Trading Problem!

The problem with the way I trade is that I have too much free time on my hands… (I never said it was a bad problem – lol!)

I have managed to load-balance the analysis work amongst other traders, and yes, I trust them as we all trade the same way. I will of course quickly read through their publicly available analysis reports to make sure that it sits comfortably with me also, but usually if an anomaly is missed by one, another trader catches it.

Obviously, we are all taught how to follow every step for ourselves so that we can do it all, but why would I do that when I have teachers providing regular lists of good trending stocks for me to analyse and whittle down?

Bottom line, my portfolio and the checking of newly provided stocks only requires a few hours per week and can be easily fitted within a family life and a full time job.

That about sums up my trading day and my strategy.

Some may be thinking – “and what about all the fundamental analysis, you haven’t once mentioned that!”

That’s right, I haven’t Why do I need to know if it is worth buying into Shell stocks, or IAG at the moment, as they are so low?

Why do I need to know that BP is buying up energy companies so even though their price is low, they will obviously rise in the future?

To a trend trader, this is known as noise. You see, those stocks serve little to no purpose as though they will possibly return a good profit in a few months, years etc, they are not returning anything now, and that is all a trend trader is interested in.

Our system is about stepping into stocks that are positively trending, NOW, or show strong potential to trend. It is not about possible positive future trends as that means that our money could be tied into a stock that is just going sideway and not working for us.

Ok Gio, that just sounds too perfect! As if you can just select positively trending stocks all the time and keep taking profit from them?

Also – “Does this method work, and if so, how good is it?”

If you asked the above questions then firstly, you’d be right, a trend trader can’t take profit from every stock. Secondly, yes it does work. Heck, the trend traders I work with had a 43% stop out rate and still managed to create a 355% profit on their traded funds.

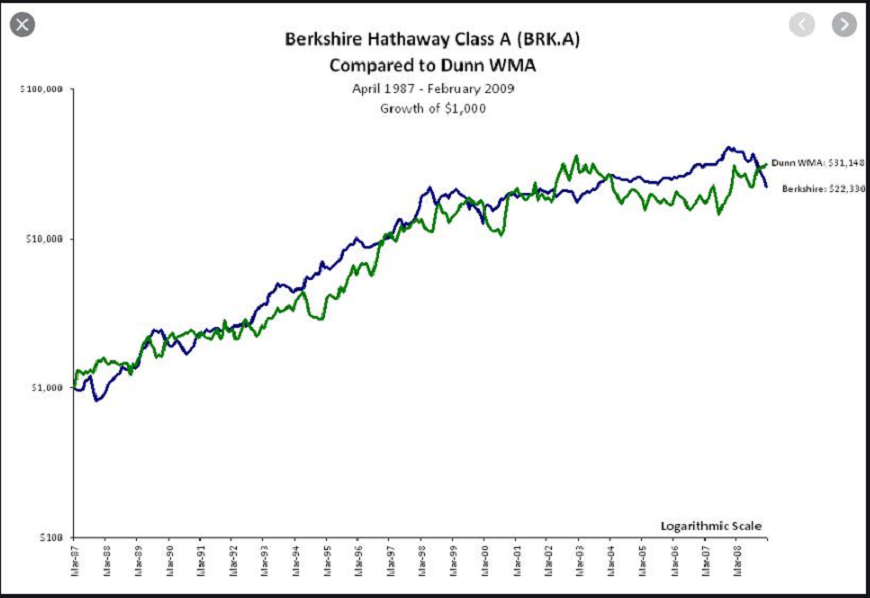

To put it another way, Investor Warren Buffets team, investing $1000 in 1987 for 22 years and doing their magic, as fair do’s they are pretty damned good at what they do, would have turned that $1000 into $22,330

Bill Dunn (trend trader) over the same time span, managed to turn that $1000 into $31,148.

Please bear in mind that I am not a day trader and I don’t sit there all day at a computer. I only trade a few hours per week as this is what works best for me.