What to look for when considering an ETF! – (simple Guide)

There are so many ETFs available nowadays, that we are actually spoilt for choice and can find one that covers just about any area.

That said, there are a few important points to bear in mind when we choose one. Going to keep this as a simple guide, mainly for personal reasons… (Ok, so that I can follow it!)

Things we should know…

1, Sector Knowledge – It would be wise to choose an ETF in a sector that one understands and has done their homework… (Just because you think that technology, or pharmaceuticals are big players and will do well, this does not necessarily mean that the ETF you choose in this industry is going to do well)

2, Fund Manager Track Record – Find out who is running this portfolio and do a little homework on this person. See their track record and get an idea of their experience.

3, Longevity – How long has this current ETF been running? This isn’t always the most important factor, though from this you can work out how it has performed to date and that is information worth knowing.

4, Expenses – Costings to hold your chosen ETF and also costings if you choose to monthly drip feed into it. Knowing your yearly costings and how you plan to fund it can also help you make a decision towards what sort of ETF is right for you… The costs of monthly drip feed and holding it will add up, so this must be worked out beforehand.

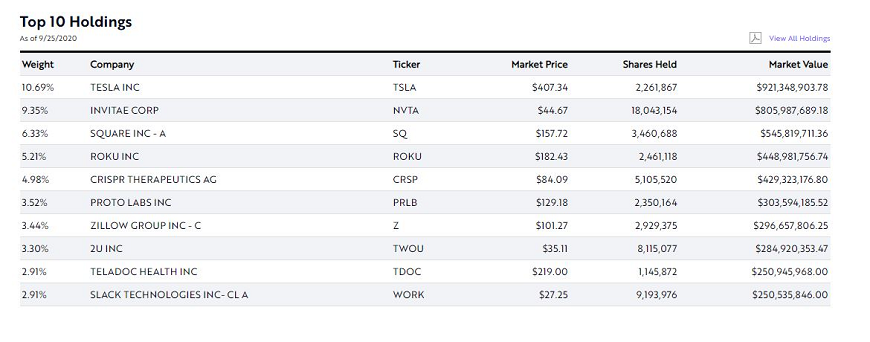

5, What’s In The Bag! – It is a good idea to look at the companies within your ETF of choice. Often there can be a heck of a lot in there, so at the very least, just do a shallow dive into it and look at the top 10.

NOTE: – When you look into the top 10 companies, I would suggest you run all 10 through your scanning software, or run your due diligence and check all 10 so as to get an idea if this is the one for you… One thing to bear in mind when looking at each company, is… “Would I invest in this individual company and does it look like it is doing well?”

Yes, it may seem like a tedious process, and yes, it may take a little while to properly look at just 10, but remember, this is YOUR MONEY you are putting on the line and you are solely responsible for making sure do the right homework and get this right.. (or as right as possible)

6, Time Scale – How long are you planning on hanging onto your ETF? Is it just for a few years? Maybe 10 years? Longer?

NOTE: – Having a planned-out goal and understanding your time scale can also help you choose the ETF that best suits your needs. For example, if you are choosing a high risk ETF and plan on holding it just for a year or two, then you are leaving yourself open to market fluctuations which means that in that few years, a dip in the market could actually end up returning you either the same as, or god forbid, less than you actually started out with, which totally defeats the object of this in the first place.

But there are quite a lot of stocks that completely outperform an ETF, so why would I choose this over them?

Yes, there are many stocks that will outperform an ETF, but with a correctly chosen ETF comes a little more stability and less worrying (depending on your method of investing).. The stocks within it should balance themselves, so if one isn’t performing too well or even takes a hit, your funds won’t take the same hit as the other stocks within it will (hopefully) pick up the slack.

Also, depending on the ETF of choice, it can be more of a passive approach to investing, especially when over long term as it is less susceptible to market corrections/dips/volatility/complete disasters, or whatever you want to call it

Lets look at ARKK Innovations ETF and see what we (ok, what I) think of that.

Ticker: ARKK

1, It has over 5 years history, has been in consolidation for a few years and has over the past few years, started to see a nice climb.

2, The Fund Manager is – Catherine D. Wood… (ok, I am not going to do your homework for you here, but from the little I have done, I would say this lady is pretty switched on and has good track record… Please do your own research on this)

3, As you can see by the attached screenshot, I have shown the top 10 holdings of what is in this bag.. Of course there are others but these 10 carry the most weight.

4, Looking at the second graph (with the candles on), ARKK seem to be maturing nicely and coming into their own, which to be fair, when one looks at the top 10 stocks, they can see why.

5, Looking at the volume on this stock, I can see that over this year alone, the volume has been growing nicely..

Jan Volume Monthly average was around 290K

Sept Monthly Average is over 2 Million(‘ish)

6’ish – I am not going to break down the top 10 stocks and list how each one is doing… (you need to do some homework 😉 ) but I would say that they are pretty good… Of course, I could be completely lying through my teeth and shouldn’t be trusted to make decisions with your money!!

7, The bag holds from around 35 to 55 stocks, which is fine.

It is an Actively Managed ETF.

I would say that this is a fund for mid to long term. Some good stocks in there. It is not a multi-managed fund and the fund covers Tech Media & Telecoms.

The above information should give you a simple breakdown into the ARKK ETF and also how to analyse other funds.

Personally, I would say that the above should be done as an absolute basic.

Why should I run the above analysis?

Firstly, it will give you a better idea if this is the ETF for you as there are so many out there, another may better suit your investment style.

Secondly, if the fund does slip a little, you are in a stronger position to make the correct decisions as you already have plenty of information on it.

Follow the above process and you will be in a better place than most when it comes to choosing an ETF that is right for you….

** NOTE **

Please bear in mind that the above is a shallow dive analysis onto researching an ETF and this process can actually be simplified if one applied Trend Trading Analysis against it.

Yes, this (and any other stocks, commodities etc) can be trend traded and one can do very well from that. It is just a matter of understanding the methodology behind this, and more than happy to point people in the right direction for some free material that gives an understanding into it if required.