The Investor Mindset Over The Salary Mindset.

Patience is an essential yet much under-appreciated skill in investing. The basis for this lack of appreciation is a combination of the need and hopes of quick riches as well as the “salary mindset” that many who venture into the money markets come in with.

What do I mean by the “salary mindset”? Well, from a young age we are encouraged to strive and work hard, as we must, to achieve success in a career choice. Most, after earning numerous qualifications, move into the world of 9-to-5 employment where they are then paid a salary.

This salary is broken down into an hourly, weekly, monthly or yearly basis. We are aware of the hours we are contracted to put in and the financial reward at the end of it.

It is this conditioning of the way money is earned that I refer to as the “salary mindset” and the same approach is then applied to the markets. In short, people turn to investing as an instant route to replacing a salary. Many make the critical mistake of quitting jobs to embark on this new found career to their own detriment. The salary mindset must be replaced with the “investor mindset” once you are in front of your charts.

Now, unless you come from a background of wealth or are financially in a strong position, having a salary is not only a must but brings other advantages to it when learning to invest, which we will explore further in this article.

First of all, one must understand that investing is a unique art with its own skill set. Like all skills, these can be learned and mastered with the right approach, training and support. Patience is one of these traits that a top investor must have.

Let’s break this down further and highlight exact points when patience is required and how, as an investor, this rewards us.

Point 1 — Waiting For The Right Environment

As an investor, my emphasis is always on capital protection and managing my downside. I can control my losses but I can not control where the market will go next. However, by understanding how to read price action and that patterns repeat, one does not need to know what the market is going to do next to make money. We simply need to understand different market conditions.

Market conditions dictate that money in investing is made in periods and not, as already mentioned, as a salary. There are times when the market is favourable to investor when we allocate risk and times when the market is not favourable and when we must stand aside.

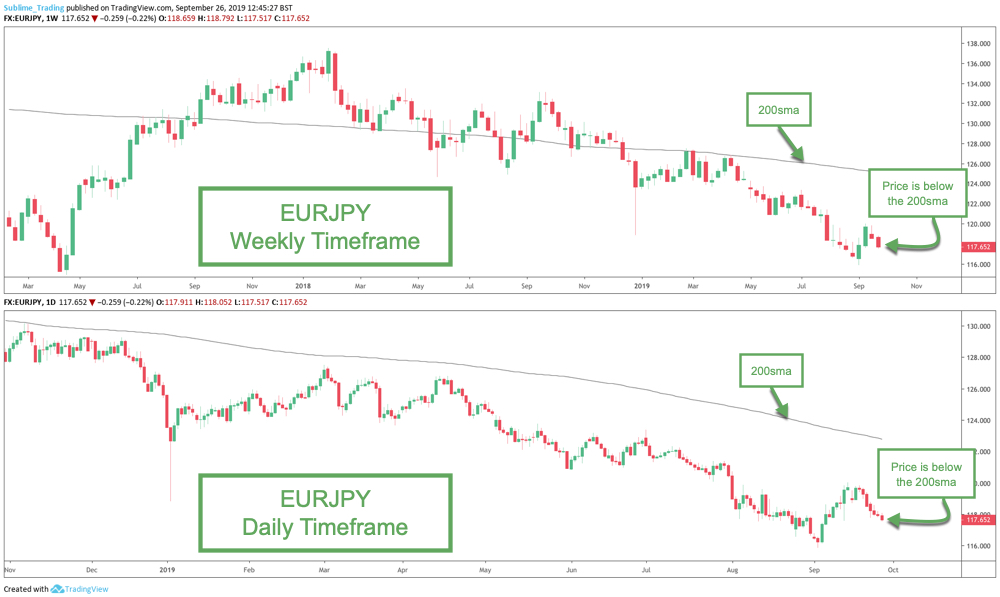

Allowing favourable high-probability environments (where price has a bias in a particular direction) to present themselves takes time and requires patience. A simple technique that I have been taught to use is to see alignment between the weekly and daily timeframes using the 200 simple moving average (sma).

We want both timeframes to be trading above the 200sma for price to have a bullish bias and where we look for long opportunities.

We want price to be below the 200sma for a bearish bias where we look for shorting opportunities.

For both timeframes to align can take lengthy periods of time and this is why having an extensive watchlist is essential. While you are applying patience and waiting for one instrument to set up, others may already have set up and are ready to invest.

This leads onto another skill of a top investor which is portfolio management, a topic for another article. Knowing how to move between trending instruments and letting go of instruments is crucial for consistent growth.

Why is allowing these environments to appear an advantage? As private investors, we do not want to invest like the institutions but want to be aware of how they invest to take advantage of the markets. With this understanding and allowing for high-probability environments to appear, we have the weight of the market in our favour meaning more chance of profit and longer periods in an investment.

We then simply need to hold our positions for as long as the trend remains in play, which can be for months. It is a smart and powerful approach and once an investor understands how to compound and experiences the exponential growth that can be achieved, applying patience and standing aside for the market to set up becomes a simple process.

Point 2 — Waiting Until The End Of The Day

Decisions should always be made when the markets are quiet. The optimal time to place an investment is at the end of the trading day, which is at 10pm or 11pm UK time, depending on the time of the year.

Breaks of support and resistance will be confirmed, increasing the odds of a trend continuation and a positive investment outcome and simultaneously avoiding intraday fake outs. Entering too early intraday is one of the reasons why many face losses which can easily be avoided by applying patience.

Entering investments when breaks and closes have been confirmed and when volatility is at a low will help remove emotions from your investing and when unrushed well-thought out decisions can be made. Remember, entering into an investment is just one aspect of investing. The stop loss, risk management, levels that price can move towards, compounding and exit management must be all pre-thought out before opening your broker account.

In addition, going back to the point I made right at the start of the article, many of you are in employment or business owners and may have a busy family life or personal life to go along with that, meaning time is short and always precious. Trying to then balance an intraday trading life as well will only lead to stress that is just not needed and ultimately, bad trading decisions.

Waiting until the end of the day and investing on the larger time frames means investing can be adapted around your lifestyle and will create a much more pleasant journey as an investor and crucially, without compromising on profit. Why? Because, in fact taking only entering a few investments a year and holding them for longer periods of time and then using the power of compounding delivers far larger returns than sitting in front of your computer and chasing money through multiple trades a day. You want a set-and-forget style and mentality.

Investing is about working smart and not hard. It is about removing any institution that you may give your money to and having complete control over it. It is about leveraging your hard-earned money to far greater returns in a safe and methodical way which will lead to complete empowerment of your time and money. It is about having the option of bringing forward the retirement phase by decades. And that is why, to repeat my point, having a job is essential. One needs a salary and savings to leverage and it brings routine and structure to your investing.

Remember, less is more!

I hope you have enjoyed the article so far and have found it useful in adapting your approach to the markets.

As always, keep it simple, keep it Sublime!